How Do You Do Forex: A Comprehensive Overview

Forex, or foreign exchange, is one of the largest and most liquid financial markets in the world. It operates 24 hours a day, five days a week, allowing traders to buy and sell currencies from around the globe. If you are looking to enter the exciting world of Forex trading, this guide aims to provide you with the foundational knowledge you need to get started. In this article, we will explore essential concepts, strategies, and tips to navigate the Forex market, including the services offered by how do you do forex trading webglobaltrading.com.

What is Forex Trading?

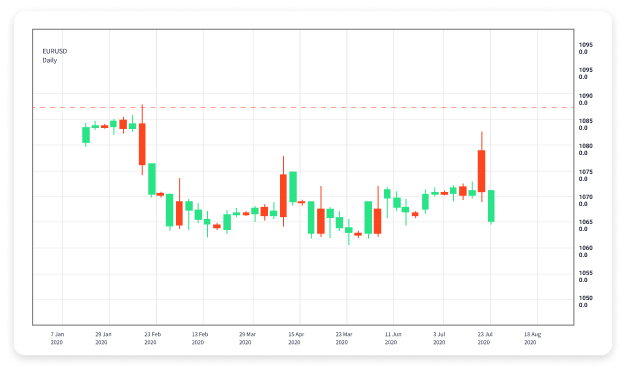

Forex trading involves the exchange of currencies in pairs, such as EUR/USD or GBP/JPY. When you trade in Forex, you speculate on whether the price of one currency will rise or fall relative to another. Unlike traditional stock markets, Forex trading does not occur on a centralized exchange. Instead, it is conducted over-the-counter (OTC) through a global network of banks, brokers, and institutions.

The Basics of Forex Currency Pairs

Every currency pair in Forex trading consists of two components: the base currency and the quote currency. The base currency is the first currency in the pair, and the quote currency is the second. For example, in the currency pair USD/EUR, USD is the base currency, and EUR is the quote currency. The exchange rate indicates how much of the quote currency you need to purchase one unit of the base currency.

Understanding Pips and Lot Sizes

A ‘pip’ (percentage in point) is the smallest price movement that a currency pair can make. In most currency pairs, a pip is equal to 0.0001. Lot size refers to the number of currency units you trade in a transaction. There are three main types of lot sizes: standard (100,000 units), mini (10,000 units), and micro (1,000 units).

How to Get Started with Forex Trading

- Educate Yourself: Learn about Forex trading through online courses, webinars, and articles. Understanding the mechanics of trading and market dynamics will enhance your chances of success.

- Choose a Reliable Broker: Select a Forex broker that is regulated and offers a user-friendly trading platform with competitive spreads and trading options.

- Open a Trading Account: Most brokers offer different types of accounts; choose one that fits your financial situation and trading style.

- Develop a Trading Plan: Create a comprehensive trading plan that outlines your trading objectives, risk tolerance, and strategies.

- Practice with a Demo Account: Before risking real money, practice your trading strategies using a demo account to familiarize yourself with the platform and market dynamics.

- Start Trading: Once you feel confident, start live trading with a small amount of capital and gradually increase your investment as you gain more experience.

Popular Forex Trading Strategies

Various trading strategies can be employed in Forex. Some of the most popular include:

- Day Trading: Involves opening and closing trades within the same day, capitalizing on small price movements.

- Swing Trading: Traders hold positions for several days or weeks to benefit from expected price moves.

- Scalping: A high-frequency trading strategy where traders aim to capture small price changes, often holding positions for just a few seconds to minutes.

- Position Trading: Long-term trading style that involves holding positions for weeks, months, or even years based on fundamental analysis.

Risk Management in Forex Trading

Effective risk management is critical in Forex trading. Some techniques include:

- Setting Stop-Loss Orders: A stop-loss order limits your losses by automatically closing a trade at a predetermined price level.

- Diversifying Your Portfolio: Avoid putting all your capital into one trade; instead, diversify by trading multiple currency pairs.

- Using Leverage Responsibly: Leverage allows you to control larger positions with a smaller amount of capital. However, it amplifies both potential gains and losses, so use it wisely.

- Calculating Risk-Reward Ratios: Before entering a trade, calculate the potential risk and reward. A common guideline is to target a risk-reward ratio of at least 1:2.

Staying Updated with Market News

The Forex market is influenced by numerous economic factors, including interest rates, inflation, and political stability. Staying updated on global financial news is essential for making informed trading decisions. Traders often follow economic calendars, read financial news reports, and utilize market analysis tools to keep abreast of important developments.

Conclusion

Forex trading offers a unique opportunity to engage with a dynamic financial market. By understanding the basics, developing effective trading strategies, and employing sound risk management techniques, you can enhance your chances of success. Remember that Forex trading requires continuous learning and adaptation to changing market conditions. Whether you’re a novice trader or an experienced participant, resources like webglobaltrading.com can provide valuable insights and tools to aid your trading journey. Start your Forex trading adventure today with a solid foundation and a clear plan!